Moreno Valley Bankruptcy Attorney

Seeking protection and relief by filing bankruptcy is not a stigmatizing event. It has helped millions of consumers and businesses and it can help Moreno Valley debtors as well by their contacting a Moreno Valley bankruptcy attorney.

Most bankruptcies are filed because the debtor or family member has suffered a setback such as a catastrophic illness or injury or loss of a job. Businesses that make poor judgments or have an investment turn sour may also seek bankruptcy protection to give them an opportunity to return to solvency.

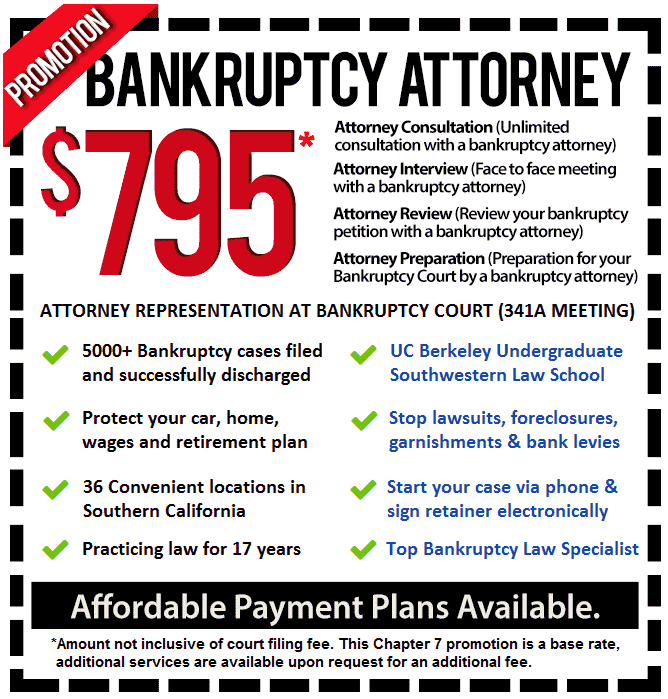

If you are a Moreno Valley consumer or business, contact a Moreno Valley bankruptcy attorney at (888) 754-9877 about the various options bankruptcy affords.

Chapter 7 can clear a debtor’s slate of unsecured debt. Chapter 13 can save a faltering small business or offer a life raft to homeowners facing foreclosure or an auto repossession. It can help Moreno Valley residents retain valuable non-exempt property and give breathing room to debtors ineligible to file under Chapter 7.

Chapter 11 filings are prepared by experienced Moreno Valley bankruptcy attorneys and give large businesses and corporations a respite from lawsuits and faltering operations by restructuring.

Consult a Moreno Valley bankruptcy attorney about your individual financial situation and see if any of these types of bankruptcy can benefit you.

Chapter 7 Bankruptcy

Moreno Valley residents with primarily consumer debt must qualify for Chapter 7. A Chapter 7 Bankruptcy Lawyer matches your income and household size to the state median. If too high, you can still pass a means test with the help of a Chapter 7 Bankruptcy Lawyer. After you take a debt counseling class, your Chapter 7 Bankruptcy Lawyer will prepare your petition containing your debts, assets, household expenses and other information. After filing, you and a Moreno Valley bankruptcy lawyer will meet with the trustee to review your petition.

A Chapter 7 liquidates unsecured debt, which is debt not secured by specific collateral. This includes credit cards and medical bills, personal loans, court judgments and some taxes. With secured debt, you can release the property back to the creditor without further obligation or reaffirm or redeem it. See a Chapter 7 Bankruptcy Lawyer about this procedure.

Before discharge, complete a short financial management class. Your discharge is generally granted about 4 months after filing.

Chapter 13 Bankruptcy

If ineligible to file Chapter 7, talk to a Chapter 13 Bankruptcy Attroeny about filing under this chapter. It is also for sole proprietorships wishing to remain in business and Moreno Valley residents in danger of losing their home, auto or boat due to arrearages. It can also benefit you if you have fallen behind in student loans, alimony or child support. If you have substantial non-exempt assets, you can keep them under Chapter 13. A Chapter 13 Bankruptcy Attroeny can review the process with you.

As a wage earner’s plan, a Chapter 13 Bankruptcy Attroeny prepares a repayment plan that pays creditors in order of priority over 3 or 5 years. A single monthly payment is made to the trustee for distribution. If you default, your case may be dismissed or converted to Chapter 7 but the plan may also be revised by a Chapter 13 Bankruptcy Attroeny if an unforeseen event is the reason.

Chapter 11 Bankruptcy

Corporations, partnerships and even small businesses facing substantial losses can file under Chapter 11. A Chapter 11 Bankruptcy Lawyer prepares a disclosure statement about the business before submitting a reorganization plan for approval by creditors. A committee or committees of creditors review it for feasibility, if it benefits them, is fair and equitable and was prepared in good faith.

Once the plan is confirmed, the business may break contracts and leases and negotiate new ones, shut down operations and seek new investors, all with the approval of the bankruptcy court. In some cases, the business merges with another or is bought out. Your Moreno bankruptcy lawyer will take care of issues as they arise.

Moreno Valley small businesses with the help of a Chapter 11 Bankruptcy Lawyer can have their petitions on a fast track that streamlines the process at less cost. Individuals can also file Chapter 11 if their debts are substantial and do not qualify for other relief though they should first consult with a Moreno bankruptcy lawyer.

Talk to a Moreno Valley bankruptcy lawyer at (888) 754-9877 if you or your business is in need of a solution to financial difficulties.